Difference Between Bookkeeping and Accounting

If you’re running a business or managing your personal finances, understanding the difference between bookkeeping and accounting is crucial. Although these terms are often used interchangeably, they actually refer to different processes in financial management. Let’s break down what each one involves and why they’re both essential for your financial success.

What is Bookkeeping?

Bookkeeping is the process of recording all the financial transactions of a business. Think of it as the day-to-day task of tracking every sale, purchase, payment, and receipt. Understanding the Difference Between Bookkeeping and Accounting is crucial, as a bookkeeper’s job is to keep an accurate record of all these activities so that you always know where your money is going.

Key responsibilities of a bookkeeper include:

- Recording daily transactions using ledgers or accounting software like QuickBooks or Zero.

- Managing accounts payable (money you owe) and receivable (money owed to you).

- Reconciling bank statements to ensure everything matches up.

- Preparing basic financial reports to give you a snapshot of your financial situation.

In short, bookkeeping is about keeping the financial books in order so you can easily see how your business is doing on a daily basis.

What is Accounting?

Key responsibilities of an accountant include:

- Preparing detailed financial statements like income statements, balance sheets, and cash flow statements.

- Analyzing financial data to identify trends and forecast future financial performance.

- Preparing tax returns and ensuring compliance with tax laws.

- Advising on financial strategies to help your business achieve its goals.

Accounting is the higher-level process that helps you understand the bigger picture, guiding you in making strategic decisions that can shape the future of your business.

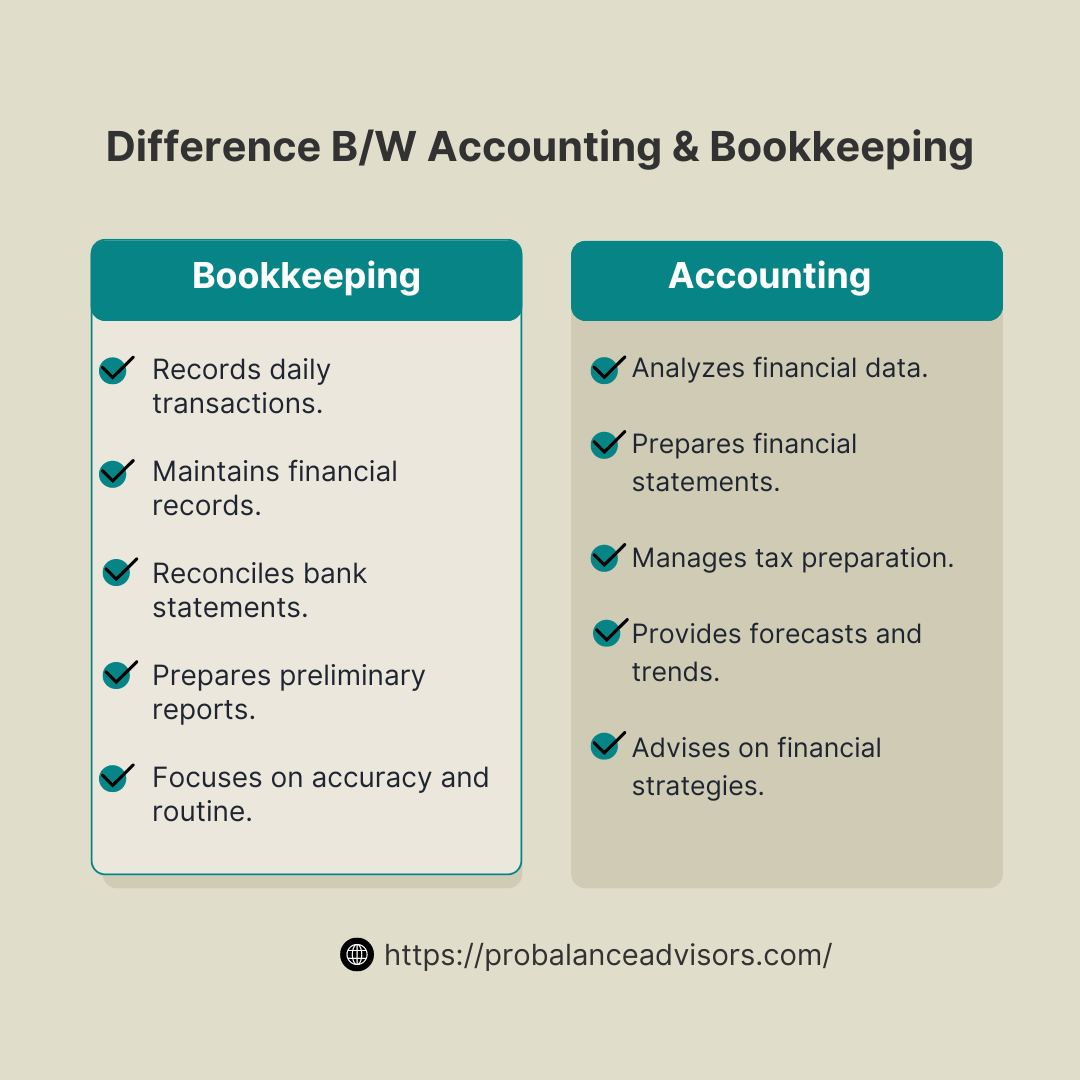

Key Differences Between Bookkeeping and Accounting

- Scope of Work:

- Bookkeeping: Focuses on recording and organizing financial data.

- Accounting: Involves analyzing, interpreting, and summarizing that data.

- Objective:

- Bookkeeping: To maintain a detailed and accurate record of all financial transactions.

- Accounting: To provide insights and financial information that support decision-making.

- Complexity:

- Bookkeeping: Generally straightforward and routine.

- Accounting: More complex, requiring specialized knowledge and skills.

- Financial Statements:

- Bookkeeping: May involve generating preliminary financial reports.

- Accounting: Finalizes these reports and ensures they meet accounting standards.

- Decision-Making:

- Bookkeeping: Provides the raw data necessary for accounting.

- Accounting: Uses this data to offer analysis and strategic advice.

Why Both Are Essential

Both bookkeeping and accounting play crucial roles in the financial health of your business. The Difference Between Bookkeeping and Accounting is essential to understand, as bookkeeping lays the foundation by ensuring all financial data is accurately recorded. Without this, accounting wouldn’t have the reliable information it needs to provide insights and advice. Together, they form a complete financial management system that helps you make informed decisions and stay compliant with legal requirements.

For small businesses, knowing the difference between bookkeeping and accounting can help you decide whether you need to hire a bookkeeper, an accountant, or both, depending on your specific needs.

Conclusion

While bookkeeping and accounting are closely related, they serve different purposes within the financial ecosystem of a business. The Difference Between Bookkeeping and Accounting lies in their focus: bookkeeping is all about recording daily transactions, while accounting takes that data and transforms it into valuable insights that guide business decisions. By understanding the distinction between the two, you can better manage your finances and ensure your business’s financial health.

At Pro Balance Advisors, we understand the Difference Between Bookkeeping and Accounting and the importance of both roles in keeping your business on track. Whether you need meticulous bookkeeping, insightful accounting, or both, our team is here to help you succeed. Contact us today to learn how we can support your financial needs

Harrison Huffman

Hello! I just wanted to say how much I appreciated this blog post. Your writing is always so engaging and informative. It's clear that you have a deep understanding of the subject matter. Thank you for sharing your expertise with us. Looking forward to your next post!

skapa ett binance-konto

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

binance referal code

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

ihtisham

How can we help drive your business ?