Chart of Accounts

Today’s competitive market, where the every cent counts and a clear understanding in managing finances is crucial. A chart of Accounts (COA) is the essential foundation of sound accounting and financial planning. But what is a chart of Accounts, why is important and how can it benefit your business accomplish the objectives you’ve decided to set? Let’s explore the background of chart of accounts, the value and benefits, as well as the possible advantages of this accounting tool which has been specifically created for those that are U.S. users.

A Brief History of the Chart of Accounts

The concept of Chart of Accounts has its beginnings in the very early beginnings of accounting. Since companies increased in complicated and complex, so did the requirement for a systematic method to record financial transactions. The idea of a Chart of Accounts became formalized by the development of double entry bookkeeping that was attributed to Italian mathematician Luca Pacioli in the 15th century. This technique, which allowed for the recording of every activity on two different accounts (debit and credit) set the basis for modern accounting practices.

In the 20th Century, we witnessed the rise of businesses becoming sophisticated, and so was the demand for a thorough and organized accounting system that could handle transactions in the financial sector. The evolution of this system created the standardized Chart of Accounts we use up to date and categorizes each financial transaction within a particular account.

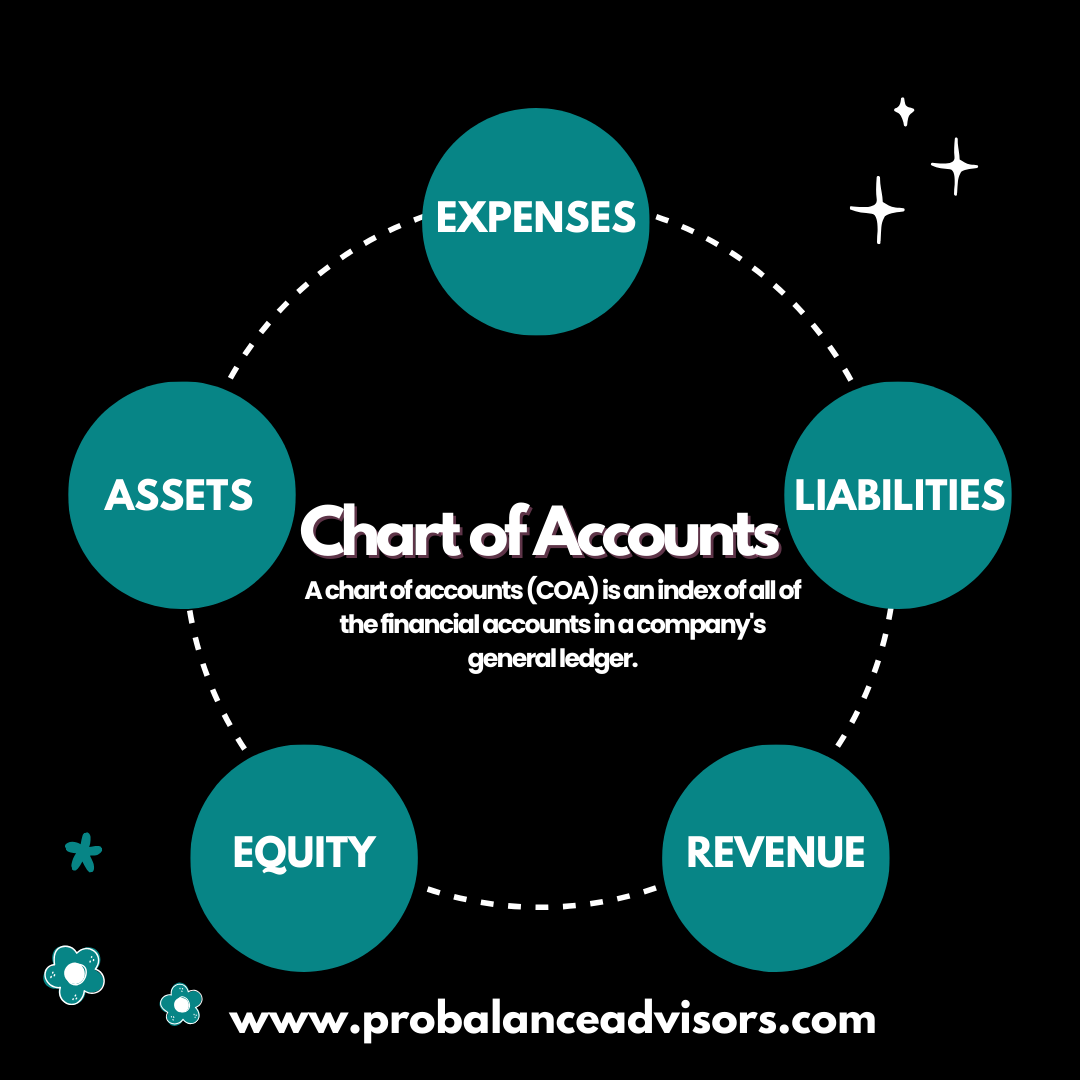

What is a Chart of Accounts?

The basic concept behind a Chart of Accounts is a tool for financial management which categorizes the different accounts used by businesses in order to track its funds. It’s basically a listing of account names as well as numbers that companies use to classify and organize finance transactions. The COA typically comprises of:

- Assets: What are the assets that a company has (e.g. inventory, cash, apparatus).

- The requirements: What’s due to the company (e.g. credit and account to be paid).

- Equity: The rights of an owner in the business (e.g. retained profits Common stock ).

- Revenue: The income from the businesses’ operations (e.g. revenues from sales, revenue from service profits).

- Costs: The expenses that are incurred during the operation of the company (e.g. rental and salaries ).

Each account in the COA is assigned a unique number. Accounts are organized by order of importance so that they can benefit from the standard accounting. The COA assists companies definitely keep track of their financial results and satisfy the demands of regulatory agencies.

Why is the Chart of Accounts Crucial for Business?

- Organized Financial Management: COA is a method that is well-organized to record and track each financial transaction and make certain that each penny is identified and classified correctly. This is crucial to ensure precise financial analysis and reports.

- Better Financial Reporting: With a well-organized COA that allows companies to create accurate financial reports like balance sheets as well as income statements easily. These statements help in assessing the financial performance of the organization and making the right decisions.

- Regulation Compliance: For businesses which operate in the U.S., compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) is vital. An appropriately-crafted COA ensures that financial statements comply to the requirements and minimizes chances of having issues with regulators.

- Helps with Budgeting and Forecasting: By separating revenue and expenditures by categories The COA helps businesses track spending patterns and changes in their income. This data can be crucial to budgeting, forecasting and as well as a strategic plan.

How the Chart of Accounts Can Improve Your Business

- Efficiency: Reduced workload An organized and clear COA makes it easier to conduct accounting. The efficiency is translated into cost and savings in time, and permits employees to focus on the other areas that are important to the business.

- Better judgement: Making more accurate and complete financial statements help in more informed decisions. Through the examination of data obtained from COA businesses can spot patterns, analyze results and apply strategic modifications that will increase their profits.

- Strategic planning informed: By gaining insights from the COA organizations can determine current financial targets and devise effective plans. Knowing where the funds come from and where it will be used helps in setting feasible goals and evaluating the development effectively.

- Improved Financial Control: properly maintained COA provides control over financial transactions that allow you to identify discrepancies as well as end fraudulent activities. An annual review of the COA will uncover areas of inefficiency and opportunities for saving money.

How to Achieve Your Chart of Accounts Goals with Pro Balance Advisors

To fully realize the potential of your Chart of Accounts (COA), it’s crucial for businesses to set clear and focused goals that lead to financial success. Whether your goal is to increase profits, cut costs, or grow your business, your COA needs to align with these objectives. Pro Balance Advisors is here to help you customize your COA to meet your company’s specific goals:

- Customize Your COA: Pro Balance Advisors will help you tailor your COA to match the unique demands of your organization. We’ll guide you in adding accounts that align with your future objectives and removing those that no longer serve a purpose.

- Regularly Review and Update: We ensure your COA remains up-to-date and effective by conducting regular reviews. As your business grows, we help your COA evolve to reflect those changes.

- Leverage Technology: With Pro Balance Advisors, you can utilize advanced accounting software to simplify COA management and automate reporting. This approach provides real-time insights and enhances the accuracy of your financial reporting.

- Seek Expert Guidance: Our team of professional accountants and financial experts will ensure your COA is accurate and perfectly aligned with your business goals.

In Conclusion

The Chart of Accounts is a crucial tool for organizing your finances and implementing strategic plans, offering benefits like enhanced transparency, improved decision-making, and goal achievement. For businesses, whether new or established, investing time in an effective COA setup can lead to long-term financial success. ProBalanceAdvisors can help by tailoring your COA to your needs, providing expert analysis, streamlining processes, and ensuring compliance, ultimately guiding you towards achieving your financial goals with confidence.